Choosing between Medicare Advantage and Medicare Supplement Insurance is a critical decision that can shape your healthcare experience and financial well-being. Each option offers unique benefits and limitations, but understanding which path best aligns with your health needs and lifestyle is essential. Whether you prioritize lower upfront costs, network flexibility, or comprehensive coverage, we’re here to guide you through this important choice—read on to find the right solution for your Medicare journey.

Those who are eligible for Medicare but aren’t fully satisfied with Original Medicare (Part A and Part B) alone are faced at a crossroads. One way leads to Medicare Advantage. The other to Medicare Supplement Insurance. The hope is that whichever one you choose will end at a destination booming with comprehensive and affordable health care.

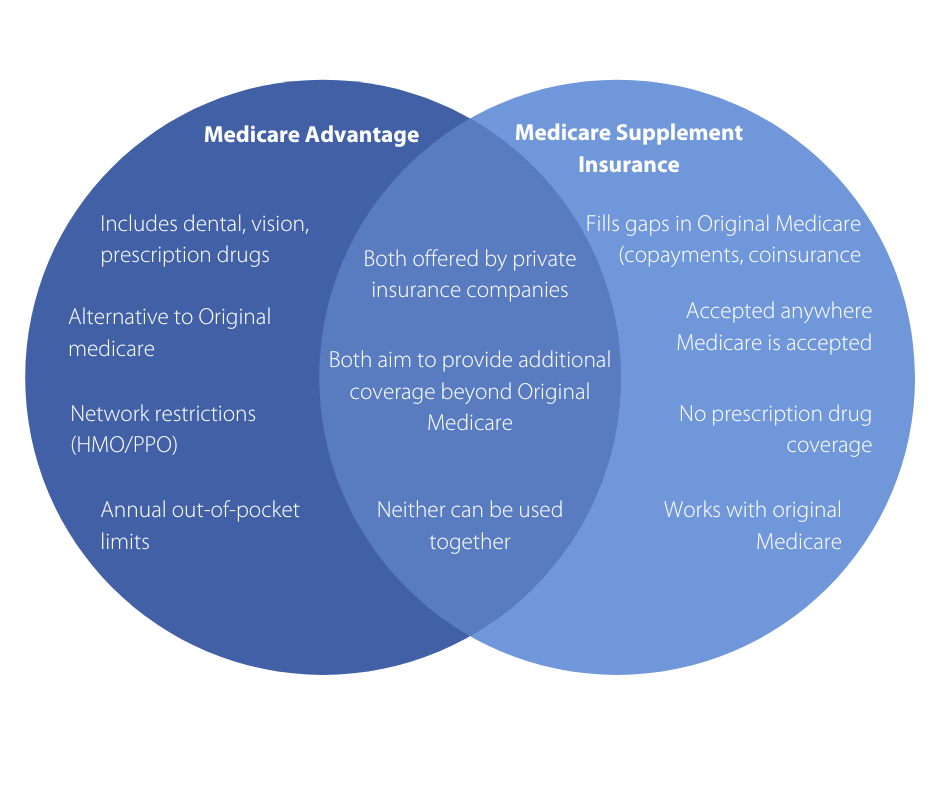

There is no byway connecting the two — Medicare Advantage plans and Medigap plans can’t be used together, and you can’t have both at the same time. So, how do you choose between Medicare Advantage, which accounts for around 33% of Medicare beneficiaries, and Medicare Supplement Insurance, which accounts for around 20% of beneficiaries?

To start, you’ll want to do your homework to fully understand how each of these plans works with Original Medicare.

The Main Difference Between Medigap And Medicare Advantage

First, a quick primer on how these types of plans differ:

Medicare Advantage is an alternative to Original Medicare. Plans must provide the same benefits as Medicare Part A and Part B. These plans may offer additional benefits on top of what Original Medicare covers. Some of the common additional benefits included in Medicare Advantage plans are prescription drug, dental and vision coverage.

Medicare Supplement Insurance (also called Medigap) provides help paying for some of the out-of-pocket expenses associated with Original Medicare, such as deductibles, copayments and coinsurance (among others). Unlike Medicare Advantage plans, Medigap are used in conjunction with Original Medicare.

Both Medicare Advantage plans and Medicare Supplement Insurance plans are offered by private insurance companies.

How To Choose

With the difference between the two options established, how does one go about choosing the best path for them? There are several factors to consider:

Cost: Medicare Supplement Insurance plans may come with higher premiums than Medicare Advantage plans but can help pay for a range of out-of-pocket costs you could run into with Original Medicare. There are 10 standardized plans available in most states with varying levels of benefits. Costs can vary by plan and location.

Medicare Advantage costs can vary by plan. Some plans may come with a $0 monthly premium. (Keep in mind, you must continue to pay your Part B premium regardless.) Out-of-pocket costs — deductibles, coinsurance and copayments — can vary as well, and you may be able to find lower out-of-pocket costs than what Original Medicare includes. Unlike Original Medicare, Medicare Advantage plans have annual out-of-pocket limits. Once you hit a certain dollar amount in your plan year, your plan will pay 100% of the costs moving forward.

It’s all about personal preference and your health care needs. Shop around and see what’s available in your area.

Provider Choice: Medicare Supplement Insurance is accepted anywhere Medicare is, giving you the freedom to visit a wide range of doctors and other healthcare providers.

Meanwhile, most Medicare Advantage plans operate under HMO or PPO formats like group or individual health insurance plans, meaning you may experience some network restrictions. Of course, that isn’t a problem if your favorite doctor is in your network. Always make sure your new Medicare Advantage plan includes your doctor in network. Insurance carrier websites usually have a search feature that helps you determine this.

Frequency Of Care: If you visit the doctor on a frequent basis, you may find yourself bogged down with the copayments and coinsurance resulting from a Medicare Advantage plan. It will depend on the plan you select.

If you buy a Medicare Supplement Insurance plan like Plan F — which covers all nine standardized benefit areas — you may encounter few out-of-pocket costs. But it could cost more up front in the form of your premiums.

Prescription Drug Coverage: It’s been reported that roughly 80% of older adults in the U.S. take at least one prescription medication daily. Medicare Part D prescription drug coverage is included in many Medicare Advantage plans, which can give peace of mind for many seniors.

Medicare Supplement Insurance offers no coverage for prescription medications. If you decide to buy a Medicare Supplement Insurance plan, you can buy a standalone, Part D private prescription drug plan to use with your Original Medicare coverage.

Additional Coverage: As previously mentioned, dental and vision coverage are some of the other popular benefits that may be included in a Medicare Advantage plan. Just like prescription drug coverage, Medicare Supplement Insurance doesn’t offer any help with dental or vision care.

Travel: A lot of people like to travel during retirement or migrate between seasonal homes. Because Medicare Supplement Insurance does not restrict patients to networks and is accepted by any provider who takes Medicare, these plans are great for patients on the move. Some Medigap plans even offer foreign travel exchange coverage for emergency care received abroad.

The Last Word

Ultimately, deciding between Medicare Advantage and Medicare Supplement Insurance requires a self-assessment of your healthcare needs and desires.

The Medicare Open Enrollment Period runs from Oct. 15 to Dec. 7 each year. During this time, enrollees of both types of plans can review their coverage and make any changes they see fit.

How much room do you have in your budget? Do you take prescription medications and need coverage for them? Do you frequently visit the doctor? Will your current doctor be in your Medicare Advantage plan’s network? These are some of the questions you should ask yourself when you reach the great fork in the road.

Original Article by Justin Adsit