The Medicare administration has announced Medicare Part A and Part B rates for 2014.

According to the Centers for Medicare and Medicaid Services (CMS) announcement, some Medicare rates in 2014 will rise slightly from 2013 levels, while others will decrease slightly or stay the same.

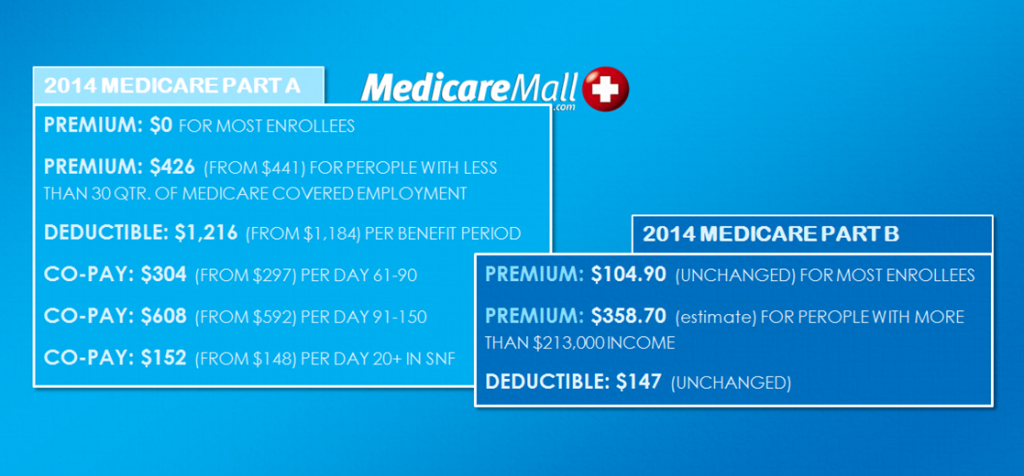

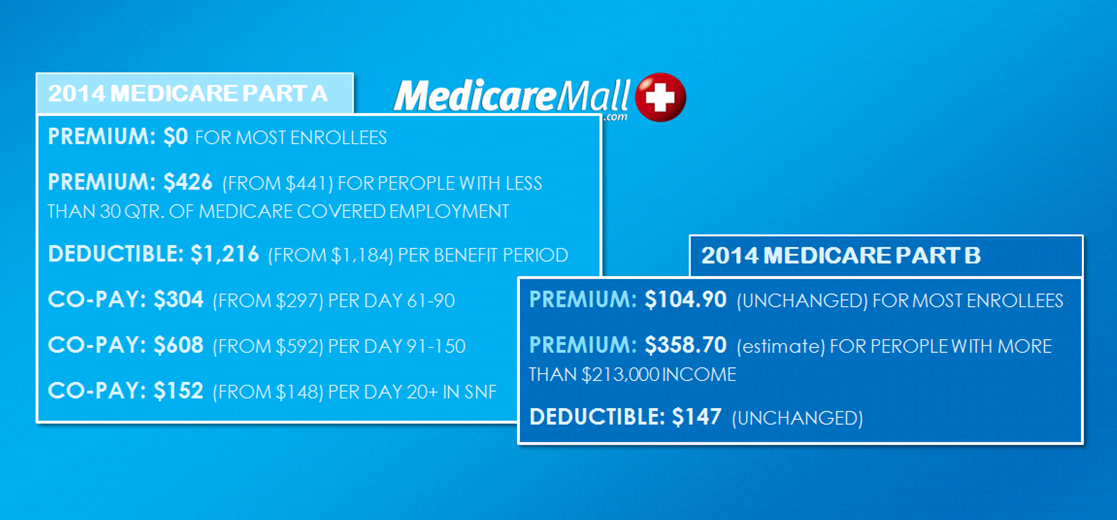

Summary of 2014 Medicare rates, as announced by CMS:

Medicare Part A

- If you’re like the vast majority of Medicare recipients and get Part A premium-free, the Part A premium increase won’t affect you at all.If you are among the roughly 1% of Medicare recipients who have to pay a Medicare Part A premium, your 2014 Part A premium will be $426, a $15 reduction from 2013.

- Your 2014 Medicare Part A deductible will be $1,216 per benefit period, up $32 from $1,184 per benefit period in 2013.

- The cost of spending 61-90 days in the hospital will be $304 per day in 2014, an $8 increase from 2013.If you’re in the hospital 91-150 days, your per-day Medicare Part A copayment in 2014 will be $608, a $16 increase from 2013.After 150 days, Medicare no longer helps pay for your hospital expenses.

- After you spend 20 days in a skilled nursing facility, your per-day Medicare Part A skilled nursing copayment in 2014 will be $152, or $4 more than in 2013.

Medicare Part B

- The standard 2014 Medicare Part B premium will remain at $104.90 per month, the same rate as in 2013. Higher Part B premium rates for people with higher incomes will also remain at 2013 levels.

- The 2014 Medicare Part B deductible will remain unchanged at $147.

The CMS press release also addresses increased savings for many people entering the donut hole phase of Medicare Part D coverage. According to CMS, over 7 million people have already saved over $8 billion as a result of Affordable Care Act (ACA) provisions aimed at closing the donut hole by 2020. CMS reports that during the first nine months of 2013, nearly 2.8 million Part D recipients saved an average of $834 on prescription drug costs.

While all of this sounds promising, it is important to remember that astronomical charges like the Medicare Part A deductible—which you can pay more than once in a year—and Part A daily hospitalization copayments—which get higher as you stay longer in the hospital—will be paid out of your pocket if your only health coverage is Original Medicare. A great solution is to contact MedicareMall for a free consultation on how to save money by making a wise investment in Medicare supplement insurance.

What is your reaction to the announced 2014 Part A and Part B rates? Please leave a comment!

© 2013 MedicareMall.com