Medicare Supplement Plan F Overview:

– Medicare Supplement Plan F is a comprehensive and popular Medigap plan that offers extensive coverage for beneficiaries enrolled in Original Medicare (Part A and Part B).

– It covers most out-of-pocket expenses, including deductibles, coinsurance, and copayments, making it one of the most robust and hassle-free plans available.

– Despite its comprehensive coverage, Plan F will no longer be available to new Medicare beneficiaries starting January 1, 2020, due to legislative changes. However, those who enrolled in Plan F before this date can keep their coverage.

Medicare with Plan F

The chart below describes the common Medicare benefits along with gaps left by Medicare for you to pay

| I. In patient | Gap (you pay) | Plan B | |

| days 1-60 | deductible* | $1,736.00 | ✔ Paid |

| days 61-90 life time reserve | coinsurance | $434.00 | ✔ Paid |

| days 91-150 | coinsurance | $868.00 | ✔ Paid |

| after 150 days Medicare quits paying | next 365 paid in full | ✔ Paid |

| II. Skilled Nursing | Gap (you pay) | Plan B | |

| Medicare pays 20 days in full | |||

| days 21-100 | $217.00 | ✖ Not Paid |

| Gap (you pay) | Plan B | |

| Annual Deductible | $283.00 | ✖ Not Paid |

| Medicare Covers 80% | 20% | ✔ Paid |

| Part B Excess | 100% | ✖ Not Paid |

| $50,000 emergency medical outside USA $250.00 deductible 80/20 | ✖ Not Paid |

*The hospital benefit period is reset by Medicare 60 days from your previous hospital release date.

Why Plan F?

Medicare Supplement Plan F has been a favored choice among beneficiaries for several reasons:

- Complete Coverage: Plan F provides the most comprehensive coverage among all Medicare Supplement plans. It covers all Medicare Part A and Part B coinsurance, deductibles, copayments, and excess charges. With Plan F, you have peace of mind knowing that almost all out-of-pocket expenses are taken care of, leaving you with little to no financial burden for medical services.

- No Network Restrictions: Unlike Medicare Advantage plans, which often have provider networks, Plan F allows you to choose any doctor or hospital that accepts Medicare patients. This means you can access healthcare services from any healthcare provider nationwide without any referrals or authorizations.

- Predictable Costs: With Plan F, you can better predict your healthcare costs since it covers the majority of expenses. Instead of worrying about varying copayments or coinsurance amounts, you only need to pay your monthly premium and any other non-Medicare-covered services.

Cost:

The cost of Medicare Supplement Plan F can vary based on several factors, including your location, age, gender, and health status. Private insurance companies offer Plan F, and they set their premiums, so it’s essential to compare prices from different providers before making a decision.

Cost Example:

Let’s consider an example to understand the potential cost savings of Medicare Supplement Plan F:

– John is a 68-year-old Medicare beneficiary residing in a specific state. He chooses Plan F, and his monthly premium is $250.

– Over the course of the year, John requires hospitalization and various medical services. Without Plan F, he would have to pay the Medicare Part A deductible of $1,484 and the Part B deductible of $203, as well as 20% coinsurance for doctor visits, lab tests, and other outpatient services.

– With Plan F, John’s out-of-pocket expenses are drastically reduced. Instead of paying the deductibles and coinsurance, he only pays the $250 monthly premium, totaling $3,000 for the year.

– John saved $1,687 on deductibles alone, not to mention the 20% coinsurance he avoided, making Plan F a cost-effective option for him.

Comparison:

To understand the benefits of Medicare Supplement Plan F, let’s compare it with other Medigap plans:

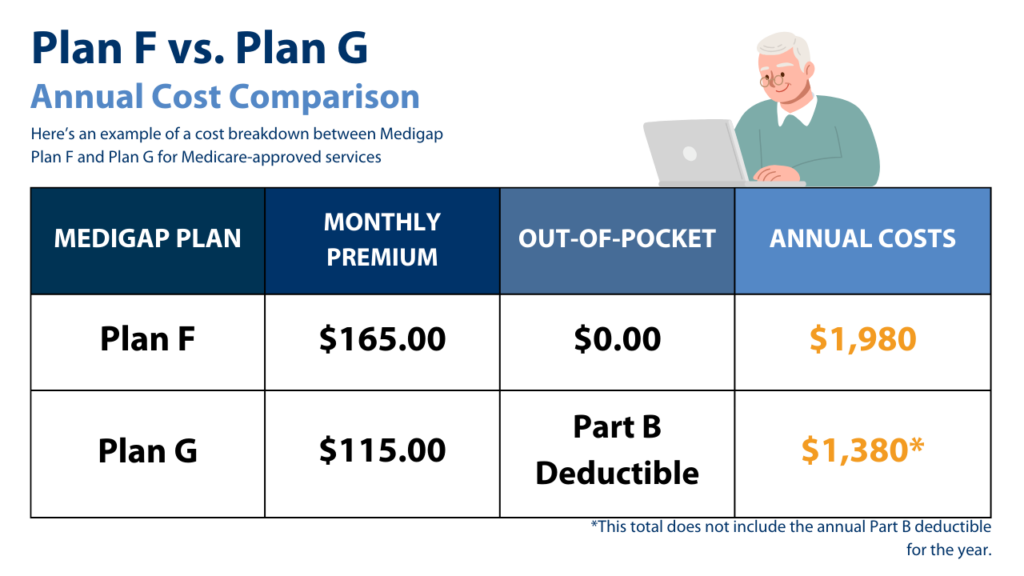

- Plan G: Plan G is similar to Plan F but does not cover the Medicare Part B deductible. For some beneficiaries, the premium savings of Plan G can outweigh the deductible cost difference, making it a popular alternative.

- Plan N: Plan N is another popular choice, offering comprehensive coverage but with some cost-sharing for specific services, such as copayments for doctor visits and emergency room visits. The lower premiums of Plan N attract individuals who are willing to pay for minor copayments as needed.

- High-Deductible Plan F: This is a variant of Plan F with a higher deductible that beneficiaries must meet before the plan coverage begins. High-deductible Plan F usually has lower premiums, but it may not be the best fit for everyone, especially those with frequent healthcare needs.

FAQs:

- Is Plan F still available for new enrollees? No, Plan F is no longer available for new Medicare beneficiaries since January 1, 2020, due to changes in legislation. However, those who were already enrolled in Plan F before this date can keep their coverage.

- When is the best time to enroll in Plan F? The best time to enroll in Plan F is during your Medigap Open Enrollment Period, which begins on the first day of the month you turn 65 and are enrolled in Medicare Part B. During this period, insurance companies must sell you any Medigap policy they offer without considering pre-existing conditions, and they cannot charge higher premiums based on your health status.

- Can I keep my Plan F if I move to a different state? Yes, you can keep your Plan F coverage when you move to a different state. Your Medigap plan is not tied to your location, and it will continue to provide coverage as long as you pay your premiums.

Reviews:

*Please note that the following reviews are fictional and provided solely for illustrative purposes:*

- Jane M. (72): “I’ve had Plan F for several years now, and I couldn’t be happier with the coverage. It has given me the flexibility to choose my doctors and specialists without worrying about additional costs. It’s worth every penny.”*

- Robert W. (67): “I switched from Plan N to Plan F, and it has made a significant difference in my healthcare expenses. With Plan F, I don’t have to worry about copayments, and it has saved me money on various medical services.”*

Takeaways:

Medicare Supplement Plan F offers unparalleled coverage for beneficiaries, covering almost all out-of-pocket expenses associated with Medicare Part A and Part B. While it is no longer available for new enrollees, those who have already enrolled in Plan F can continue to enjoy its benefits. Before choosing any Medigap plan, it’s essential to compare options, consider your healthcare needs and budget, and explore other available plans like Plan G or Plan N. By understanding the costs and benefits of different plans, you can make an informed decision and find the best Medicare Supplement plan to suit your unique healthcare needs.