Medicare Part A, also known as Medicare Hospital Insurance, is a fundamental component of Original Medicare. It provides coverage for inpatient hospital care, skilled nursing facility care, hospice, and some home health services. Understanding what Medicare Part A covers, its costs, and how to enroll can help you make informed decisions about your healthcare.

What Does Medicare Part A Cover?

Medicare Part A primarily covers inpatient hospital care. This includes your room and board in a hospital, which typically consists of a semi-private room and your daily meals. Part A also covers:

- Medications and Lab Services: Any medications administered by the hospital and necessary lab services are included.

- Skilled Nursing Facility Care: Post-hospitalization skilled nursing care is covered, provided it is medically necessary and follows a qualifying hospital stay.

- Home Health Services: Short-term, medically necessary home health care is covered when skilled nursing is also involved.

- Hospice Care: For those with terminal illnesses, Part A covers hospice care, including palliative care, medical equipment, and counseling.

However, it’s important to note that Medicare Part A does not cover long-term care, such as extended stays in a nursing home. If you anticipate needing long-term care, you may want to consider purchasing long-term care insurance.

How Much Does it Cost?

Is Medicare Part A free?

For most people, yes. If you or your spouse have worked for at least 10 years (40 quarters) in the U.S. and paid Medicare taxes, you won’t pay a premium for Medicare Part A at age 65. This is often referred to as “premium-free Part A.”

What if I don’t qualify for premium-free Part A?

If you haven’t worked the required 10 years, you can still purchase Part A. The premiums in 2024 are as follows:

- $505 per month if you have less than 30 quarters of work history.

- $278 per month if you have 30-39 quarters of work history.

For more detailed information on the cost of Medicare Part A, visit our Medicare Costs page.

Enrollment in Medicare Part A

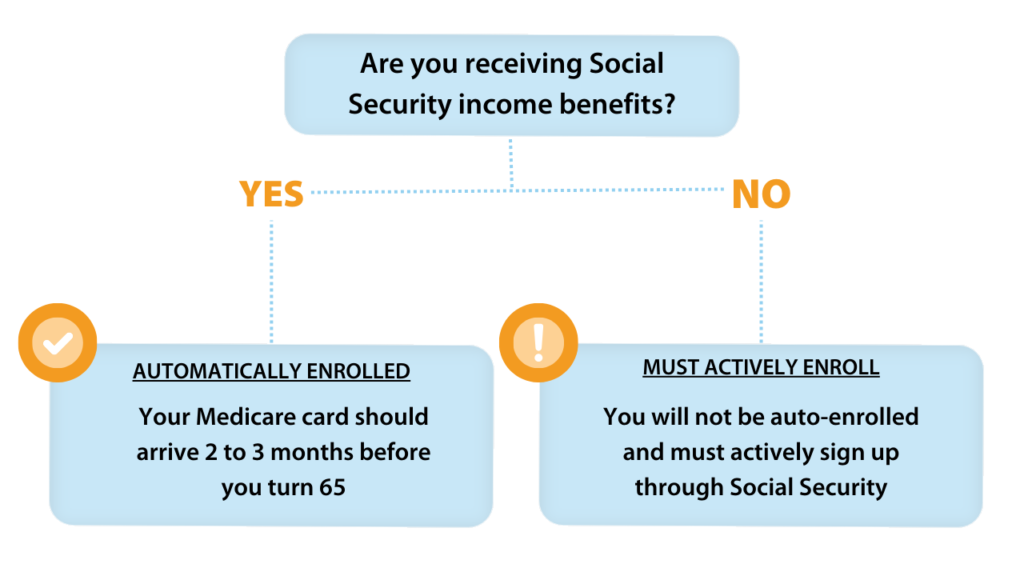

Automatic Enrollment:

If you are already receiving Social Security or Railroad Retirement benefits, you’ll be automatically enrolled in Medicare Part A when you turn 65. You should receive your Medicare card in the mail 2-3 months before your 65th birthday.

Manual Enrollment:

If you are not receiving Social Security or Railroad Retirement benefits, you’ll need to actively sign up for Medicare Part A. You can easily enroll through the Social Security Administration’s website.

“How do I enroll in Medicare Part A?”

Medicare Part A Cost-Sharing

While Medicare Part A covers a significant portion of your hospital costs, you are still responsible for certain cost-sharing amounts, including a deductible and coinsurance. Here’s what you can expect in 2024:

- Inpatient Hospital Deductible: $1,632 per benefit period (each time you are admitted after 60 days out of the hospital).

- Coinsurance for Extended Hospital Stays:

- $408 per day for days 61-90.

- $800 per day for days 91-150 (using lifetime reserve days).

- Lifetime Reserve Days: Medicare Part A gives you 60 lifetime reserve days for hospital stays longer than 90 days. Once these are used, you will be responsible for all costs beyond day 90.

Skilled Nursing Facility Costs:

- The first 20 days in a skilled nursing facility are fully covered.

- For days 21-100, you will pay a daily copayment of $204.

Fortunately, Medigap policies and Medicare Advantage plans can help cover some of these costs, reducing your out-of-pocket expenses.

Common Questions About Medicare Part A

How do I sign up for Medicare Part A only?

If you have creditable coverage and want to delay other parts of Medicare, you can enroll in Part A only through the Social Security Administration website.What is the difference between Medicare Part A and Part B?

Medicare Part A covers inpatient hospital services, while Part B covers outpatient services like doctor visits and preventive care.How much is Medicare Part A?

Most people qualify for premium-free Part A, but those who don’t may pay up to $505 per month, depending on their work history.

To learn more about Medicare Part A or to get help with your Medicare needs, contact our Medicare insurance experts at (817) 249-8600 for a FREE consultation!