Medicare Advantage vs. Medigap: Understanding the Key Differences

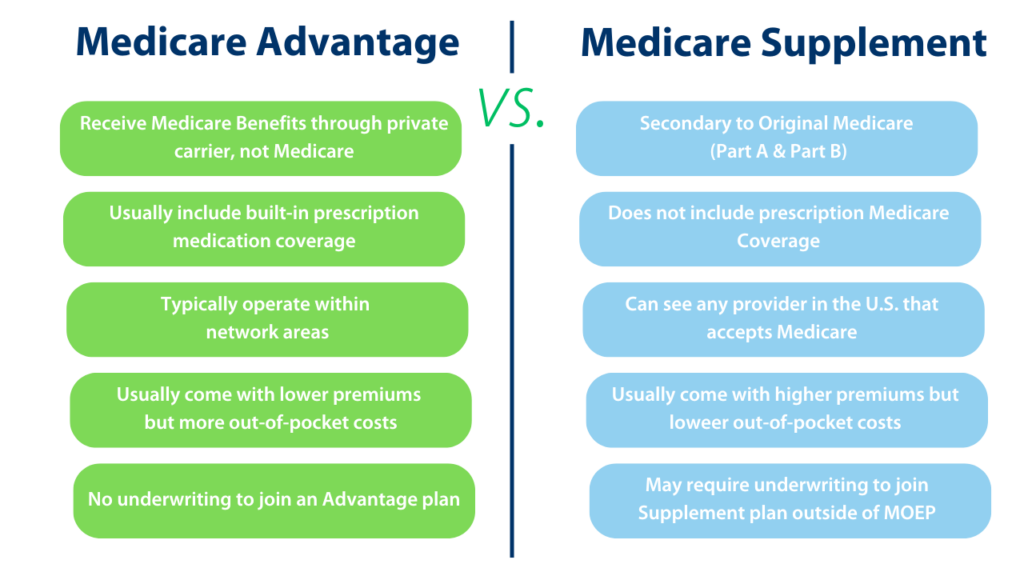

Navigating the complexities of Medicare can feel overwhelming, but it doesn’t have to be. With the right guidance and information, you can confidently choose a plan that suits your unique needs. At Medicare Mall, we understand that every individual’s situation is different, and we’re here to help you make the best choice. When comparing **Medicare Advantage vs. Medigap**, it’s important to understand their key differences. Medicare Advantage plans (Part C) replace Original Medicare and often include benefits like prescription drug coverage, while Medigap works alongside Original Medicare to cover out-of-pocket costs such as copayments and deductibles.

Medigap Plans:

– Medigap plans are standardized by the federal government, meaning each plan type offers the same coverage regardless of the insurance company selling it.

– There are ten standardized Medigap plan types, labeled by letters (e.g., Plan A, Plan F, Plan G), each providing different levels of coverage.

– Medigap plans do not include prescription drug coverage, so beneficiaries need to enroll in a separate Part D plan if they want prescription drug benefits.

– Medigap plans allow beneficiaries to see any healthcare provider that accepts Medicare, giving them greater flexibility in choosing doctors and specialists.

– The primary advantage of Medigap plans is their comprehensive coverage, which helps limit out-of-pocket expenses for healthcare services. However, these plans generally have higher monthly premiums compared to Medicare Advantage plans.

Medicare Advantage Plans:

– Medicare Advantage plans are offered by private insurance companies approved by Medicare and provide all the benefits of Original Medicare, but they may include additional services like dental, vision, and fitness programs.

– There are various types of Medicare Advantage plans, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-for-Service (PFFS), and Special Needs Plans (SNP), each with its own set of rules and provider networks.

– Medicare Advantage plans often have lower monthly premiums than Medigap plans but may require copayments and coinsurance for healthcare services.

– Many Medicare Advantage plans include prescription drug coverage (MA-PD plans), eliminating the need for a separate Part D plan.

– These plans typically have provider networks, and beneficiaries may need referrals to see specialists or out-of-network providers, except in emergencies.

– A trial right allows beneficiaries to try out a Medicare Advantage plan for up to 12 months and switch back to Original Medicare with Medigap during that period if they are not satisfied with the Advantage plan’s coverage.

Medigap Plans:

Medigap plans are supplemental insurance plans designed to work alongside Original Medicare (Part A and Part B). They fill in the “gaps” in coverage left by Original Medicare, such as deductibles, copayments, and coinsurance. The government standardizes Medigap plans, meaning each plan type offers the same benefits regardless of the insurance company selling it. This makes it easier for beneficiaries to compare plans and choose the one that best suits their needs.

Medigap Plan Types:

There are ten standardized Medigap plan types, labeled with letters from A to N. Each plan type offers a different set of benefits, with Plan A being the most basic and Plan F (phased out in 2020) offering the most comprehensive coverage. Plan G is now considered the most comprehensive option, covering all of the “gaps” except for the Part B deductible.

How Medigap Works with Medicare:

When a beneficiary has Original Medicare and a Medigap plan, Medicare pays its share of approved costs, and then the Medigap plan covers some or all of the remaining out-of-pocket expenses, depending on the plan type. This can lead to minimal to no out-of-pocket costs for covered services.

Pros of Medigap Plans:

– Comprehensive coverage that limits out-of-pocket expenses.

– Freedom to see any healthcare provider that accepts Medicare.

– No need for referrals to see specialists.

– Coverage is standardized, making it easier to compare plans.

Cons of Medigap Plans:

– Generally higher monthly premiums compared to Medicare Advantage plans.

– Does not include prescription drug coverage, requiring the purchase of a separate Part D plan.

– Coverage may vary depending on the state and insurance company offering the plan.

– No additional benefits like dental or vision coverage.

Medicare Advantage Plans:

Medicare Advantage plans are an alternative to Original Medicare, provided by private insurance companies approved by Medicare. These plans must offer at least the same benefits as Original Medicare (Part A and Part B), but many include additional services like dental, vision, hearing, and fitness programs. Some Medicare Advantage plans also include prescription drug coverage (MA-PD plans).

Types of Medicare Advantage Plans:

There are different types of Medicare Advantage plans, each with its own rules and provider networks:

– Health Maintenance Organization (HMO) plans require beneficiaries to use in-network providers and typically need referrals to see specialists.

– Preferred Provider Organization (PPO) plans allow beneficiaries to see both in-network and out-of-network providers, but out-of-network care is generally more expensive.

– Private Fee-for-Service (PFFS) plans determine how much they will pay doctors and other healthcare providers and how much the beneficiary must pay.

– Special Needs Plans (SNP) are tailored for beneficiaries with specific health conditions, like diabetes or end-stage renal disease.

Pros of Medicare Advantage Plans:

– Lower monthly premiums compared to Medigap plans.

– Many plans include prescription drug coverage (MA-PD plans).

– Some plans offer additional benefits like dental, vision, and fitness programs.

– Plans may coordinate care for chronic conditions through special programs.

Cons of Medicare Advantage Plans:

– Beneficiaries may need to use in-network providers, limiting their choice of doctors and specialists.

– Copayments and coinsurance can apply for healthcare services, leading to higher out-of-pocket costs.

– Rules and coverage may change from year to year.

– Certain services may require prior authorization or may not be covered.

Determining the Best Option:

Deciding whether to choose a Medigap plan or a Medicare Advantage plan depends on individual preferences, healthcare needs, and budget. Here are some factors to consider:

Consider Medigap If:

– You prefer comprehensive coverage and predictable out-of-pocket expenses.

– You want the freedom to see any doctor or specialist without needing referrals.

– You are willing to pay higher monthly premiums for more extensive coverage.

– You already have prescription drug coverage through other means (e.g., employer-sponsored plan).

Consider Medicare Advantage If:

– You want lower monthly premiums and are willing to accept copayments and coinsurance for healthcare services.

– You prefer a plan that includes additional benefits like prescription drug coverage, dental, vision, and fitness programs.

– You are comfortable using a specific network of healthcare providers and potentially need referrals for specialists.

– You are open to trying out a plan with the option to switch back to Original Medicare during the trial period if necessary.

Three Takeaways:

– Medicare Advantage plans (Part C) replace Original Medicare and often include additional benefits, while Medigap plans supplement Original Medicare to cover out-of-pocket costs.

– Medigap plans are standardized and offer more freedom in choosing healthcare providers, but they have higher monthly premiums and do not include prescription drug coverage.

– Medicare Advantage plans come in various types with lower premiums but require using a specific network of providers and may have copayments and coinsurance. They may also include prescription drug coverage and other extra benefits. The decision between the two types

of plans should be based on individual healthcare needs and preferences.