What Is a Medicare PPO Plan?

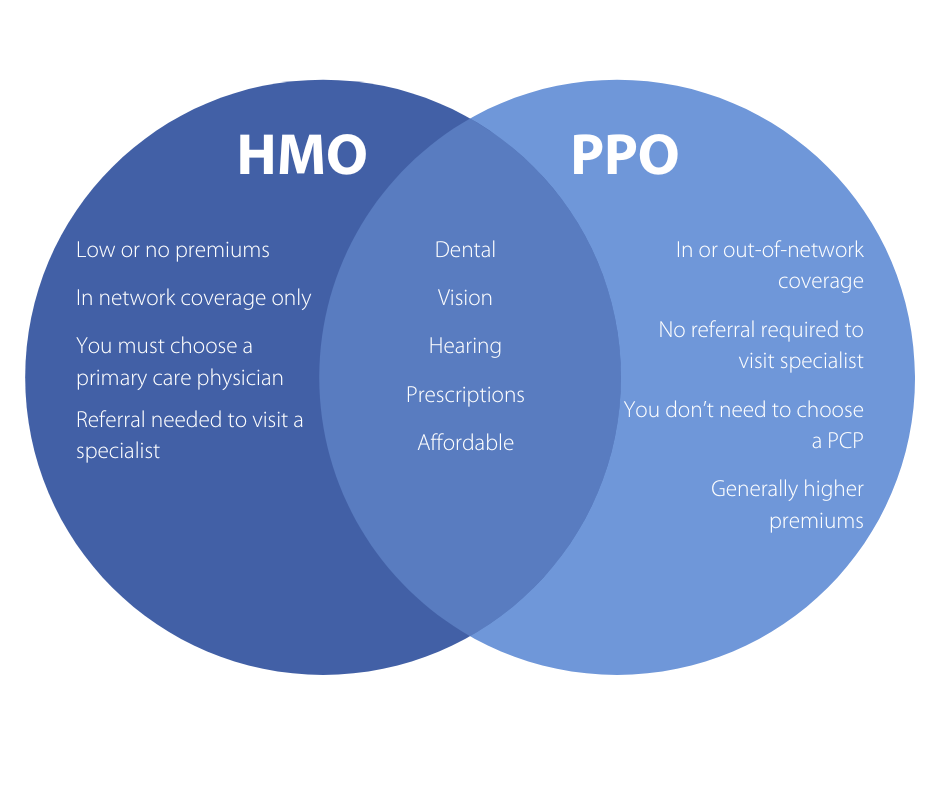

Preferred Provider Organization (PPO) Plans are a type of Medicare Advantage (Part C) plan that offers flexibility in how and where you receive care. PPOs allow you to see any doctor or specialist—in or out of the network—without needing a referral.

You’ll typically pay less when using providers within your plan’s network, but you’re not restricted to network providers, making PPOs ideal for those who want more provider choice.

Key Benefits of PPO Plans

More Freedom to Choose Providers

- You can see out-of-network providers, though at a higher cost

No referrals needed to see specialists

All-in-One Coverage

Covers Medicare Part A (hospital) and Part B (medical) services

Most PPOs also include Medicare Part D (prescription drug coverage)

Frequently includes dental, vision, hearing, wellness, and telehealth benefits

Emergency and Urgent Care Nationwide

All PPO plans cover emergency and urgent care regardless of provider network

What’s the Cost of a PPO Plan?

PPO plans typically come with:

Monthly premiums, which vary by insurer and location

Part B premium, which you continue to pay

Copayments and coinsurance, especially for out-of-network services

An annual out-of-pocket maximum to help protect you from excessive costs

Costs vary depending on where you live and the plan provider. Some PPO plans have $0 premiums, while others may charge more for added benefits or broad provider networks.

Medigap and Medicare PPOs

If you join a Medicare Advantage PPO Plan, any Medigap (Medicare Supplement) policy you have will no longer coordinate with your plan. While you are legally allowed to keep your Medigap plan, it won’t help cover copayments or deductibles under your Medicare Advantage plan.

For this reason, most people drop Medigap coverage when enrolling in a PPO or other Medicare Advantage plan.

Who Should Consider a PPO Plan?

You might benefit from a Medicare Advantage PPO if you:

Travel often or live in multiple locations during the year

Want access to a broader range of doctors and hospitals

Prefer not to get referrals for specialist visits

Are okay with potentially higher out-of-pocket costs for flexibility

Plan Availability and Support

Medicare Advantage PPO plans are offered regionally, and availability varies by county and zip code. Premiums, coverage features, and provider networks can change annually.

At MedicareMall, we help you:

Compare available PPO plans in your area

Review drug formularies and provider lists

Understand coverage exclusions and cost structures

Enroll quickly and confidently with support from licensed experts